Is a Captive Insurance Program Right for Your QSR Franchise?

Have you been approached about joining a Captive Insurance Program? Do you need help evaluating whether or not it is a good option for your quick service restaurant franchise? KNOW THE FACTS.

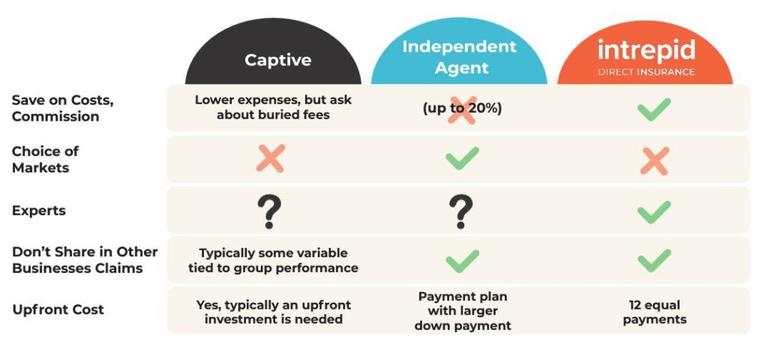

As a business owner, you have probably heard of a Captive Insurance Program with benefits like “underwriting flexibility”, “greater control over claims”, and “share in the profits of the program”. While these are all attractive features that are possible with a Captive Insurance Program, a number of factors should be considered when evaluating this option for your business.

What is a Captive Insurance Program?

Captive Group Insurance Plans, put simply, are an insurance company owned by the organizations it insures. Rather than paying a conventional commercial insurance company, captive owners retain certain risks at lower costs while transferring others (often, catastrophic losses) to an insurer.

Though Captives are a hot topic as an alternative- buyer beware. One must consider the following risks when reviewing any captive option:

- Long-term commitment

- Upfront costs

- Complexity

- Risk

What to evaluate when considering joining a Captive Insurance Program

Promoters of captive programs love to talk about the upside, but there is no such thing as a free lunch. With the complexities of Captive Group Insurance Plans and the grounds for IRS challenges, it’s imperative that legal and tax advisors implement the integration as part of the overall risk, business, and tax strategy… resulting in substantial management fees. While this model may initially result in lower expenses, you must carefully examine:

- Buried fees

- Upfront costs

- Potential for nonpayment of claims if improperly funded or managed

- Required reinsurance costs, which means you typically can’t avoid changing trends in the market

- The dependency on others in your captive program to also perform well with losses

This can all get very complex and create significant risk for your organization.

Alternatives to a Captive Insurance Program

The direct-to-consumer alternative is newer to the quick service restaurant “QSR” space. This model means you work directly with the insurance company versus an agent or broker. Direct insurance is great for owners that want:

- Savings

- Better control

- Transparency

- Better experience

Cutting out the middleman (an agent or broker) not only saves you the 20% agency commissions but also allows you to be closer to the decision-makers in the insurance company.

When shopping for solutions for your business, we know the importance of researched decisions and good relationships. We understand that Captive Group Insurance Plans have their place in the QSR industry, but they are not a “one size fits all”. At Intrepid Direct, we offer you an easy way to compare a direct quote to other insurance alternatives with our no-pressure, no-obligation approach. We want to help you get all of the facts and make an informed decision.

Check out our full comparison sheet with topics to consider when choosing an insurance partnership for your QSR business.

Categories

Recent Posts

Request a Quote

Ready to take control of your insurance? Request a quote and get the coverage you need all in one place. Remember your broker can’t access us and we don’t interfere with their marketing.