Is Telematics The Right Investment For Your Delivery Franchise?

Restaurant franchisees leveraging driver data have a distinct advantage over those who are not. We’re serving up everything you need to know about telematics before making a decision to implement.

While some restaurant franchisees are posting record sales numbers, expenses are becoming increasingly difficult to wrangle. This is leaving many delivery franchisees wondering if investing in new tech like telematics is really all it’s cracked up to be.

A recent report released by Bank of America Securities Global Research revealed that the average franchisee’s EBITDAR margins post-royalties peaked in 2016 at 20.8%. What’s not helping? A difficult insurance market. Insurance premiums for Hired and Non-Owned Auto (HNOA) and Umbrella coverage are on the rise. And for some franchisees, it’s not by a little, but by a lot.

The phenomenon that is “social inflation” is driving jury awards ever upward and the insurance industry has no choice but to respond responsibly. While it’s a relatively new buzzword, social inflation’s impact on your business is anything but temporary or trivial – especially if you’ve experienced a large claim.

It’s not all grim, though. These challenges have inspired innovators and disruptors to bring forward impressive solutions that put power back into the hands of operators. The one we’re most excited about? You guessed it: Telematics.

Restaurant owners leveraging driver data have a distinct advantage over those who are not, so we’re serving up everything you need to know before making a decision to implement.

Telematics: What it is, what it’s not, and how it works

Before we get into this, you should know that while we strongly believe in the power of this technology, it’s not a cut-and-dry “you’ve gotta have it” recommendation. The truth is, that implementation and adoption make more sense for some businesses versus others. We also want to make it clear that we do not make money off of selling or promoting the idea of telematics, its devices, its data, or promoting any particular providers. So what’s in it for us? Keep reading and you’ll see that our clients who successfully utilize telematics report fewer, and less severe claims. Because of this, our clients are less risky and we’re able to offer and keep their rates competitive. This means we can win more business and keep it. Plus, we get to help our clients be better business owners, which is also pretty awesome.

What telematics is

Telematics uses a combination of GPS technology and diagnostic data to monitor movement for the purposes of tracking an asset. Telematics uses a device connected to a cellular network to upload information to a server where it can then be aggregated, analyzed, and accessed by the end user through a data visualization software system.

For the delivery-driven restaurant, “telematics” has been coined as the method for measuring, monitoring, and optimizing driver behavior.

What Telematics is not

While telematics uses GPS technology, it’s not necessarily a replacement for the productivity trackers you may already be using. GPS provides insights on driver whereabouts for customers or in-store logistics, but alone won’t marry location information to the driving behaviors most likely to lead to an accident.

This is where third parties like Drivosity, a leading provider of telematics solutions for first-party delivery operations, are jumping in to help.

How telematics works

Drivosity’s system (and all telematics systems) look at four driving components: speeding, cornering, braking, and acceleration. On each trip, the technology tracks the number of times a driver deviates from scientifically proven safe driving tolerances. With Drivosity’s technology, specifically, a DriveScore® is produced at the end of each trip, letting managers know how the driver performed.

Telematics provides an unparalleled line of sight into your employees’ behavior after they leave the parking lot. Trends emerge and behaviors can be coached, celebrated, or terminated as management sees fit.

Your insurance company wants to insure safe drivers

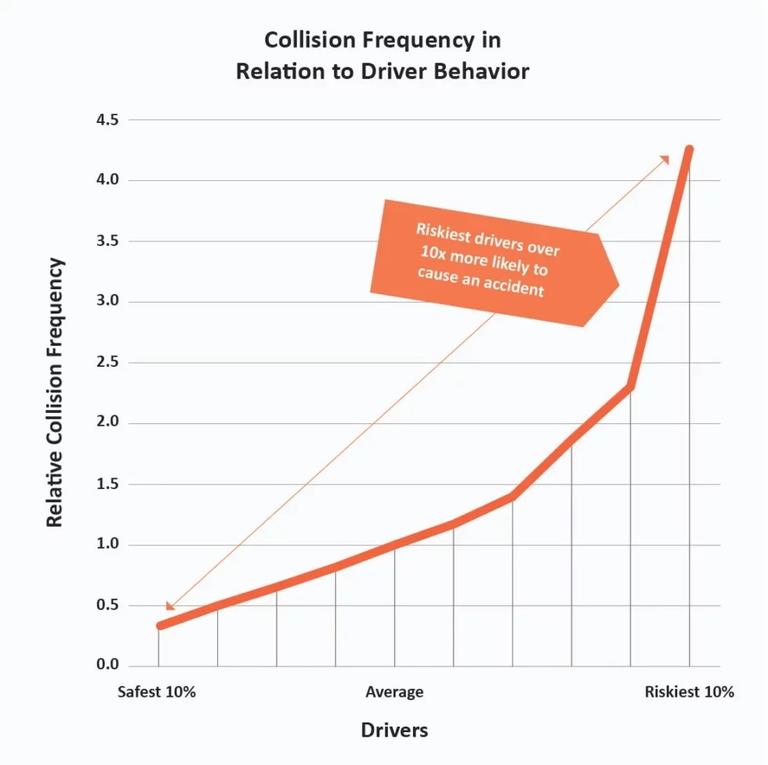

Telematics data clearly shows there is a direct link between dangerous driving behaviors and the likelihood of being involved in a crash – even when there is less traffic on the road. This hypothesis has been tested and proven across a variety of public studies, including governmental, industry whitepapers, and public insurance company filings. The chart below illustrates, using this publicly available data, a nearly 10 times increase in collision risk for the riskiest drivers on the road compared to the average.

How most insurance companies determine your Hired & Non-Owned Auto premium

Simply put, insurance companies determine how much you’ll pay for coverage based on the amount of risk your business presents. The more risk, the more you’ll pay. And the same should be true the other way around. But how does an insurance company know if your drivers are safe, average, or risky?

If you’re not using telematics, most insurance companies use figures like industry averages, their historical losses, your historical losses, and information about your operations to predict how much your drivers will “cost” them in terms of future claims. Without telematics, you’re working against industry averages, that one bad claim you had 7 years ago, and the historical driving records (both good and bad) of the other clients the carrier covers. Those are all built into the actuarial models that determine your price – which means there’s a high likelihood you’re overpaying for your insurance.

How to use telematics to lower the cost of your Hired & Non-Owned Auto premium

Using telematics within your organization should, in theory, lower your Hired & Non-Owned Auto (HNOA) and Umbrella premiums. This largely depends on your insurance provider recognizing telematics as a proven method for improving driver behavior and removing risky drivers from the road.

At Intrepid Direct, we believe telematics helps franchisees identify, mitigate, and remove problematic drivers that will eventually cost you (and us) money, tarnish your brand, or cause the unthinkable. Not only has telematics been proven to reduce the number of claims filed with us, but it has also reduced the severity of the accidents we see. These are impressive and meaningful figures for your staff, their families, your community, and us – which is why we offer franchisees deep discounts on their premiums when they use and manage it.

The benefits of telematics beyond safety

While the obvious benefit of utilizing telematics is safety and savings, our clients tell us that the benefits stretch beyond the obvious (but we’ll include those below too). Here’s what we hear from our current first-party delivery clients who have installed a telematics system:

- Operators receive lower HNOA and Umbrella premiums

- Customers (and potential customers) notice and appreciate safe drivers in their neighborhoods

- Employees express gratitude about working for an employer who prioritizes their safety

- Managers appreciate having an improved line of sight after employees leave the parking lot

- Morale is higher around the store (for a variety of reasons: a safe working environment, in-the-moment feedback, friendly competition around driving scores, etc.)

- Employees feel more engaged in the store’s performance and financial outcomes

- And as mentioned briefly above, managers can provide employees with real-time feedback

The most common objections franchisees have when considering telematics answered

If you’re still not sold, you’re not alone. We work with franchise operators of all sizes, from all walks of life, across many different brands, in every state. The one thing they all have in common is that they have a lot of questions about how this type of program actually works from day to day. So here are the most common questions (more like objections) we hear from our end, and the feedback we give when our clients consider telematics for their franchise delivery restaurant:

It costs too much!

Implementing telematics should be viewed as an investment in your team’s safety – and one that will mitigate the future risk of extraordinary litigation and ongoing insurance costs. New, more affordable mobile technology is emerging to combat cost concerns, so be sure to look at all your options. We recommend working with an insurance provider that will give you an immediate and ongoing discount on your HNOA and Umbrella premiums to offset the initial investment.

I'm too busy.

Today’s systems make the day-to-day easy to manage successfully. Most are “gamified,” so participants are excited to engage in friendly competition for the best scores. Results are nearly-immediate plus most providers offer out-of-the-box reports that can be delivered through automation. Plus, great insurance providers (wink, wink) will help you benchmark and manage outcomes. We often see larger operators tag their HR teams for assistance in developing safe driving rewards programs and policies and procedures that remove unsafe drivers from the road. If you don’t have the luxury of a dedicated HR resource, don’t be intimidated to take this on. Your KPIs (key performance indicators) are already defined (speeding, cornering, braking, accelerating), and your provider should be able to give you targets to hit. All you have to do is determine how to celebrate wins and address issues.

I can't afford to lose drivers.

Driver resistance to the technology is low – which is great news considering today’s hiring and retention challenges. The adoption of telematics within the personal auto industry has helped with this, coupled with the message that you’re investing in your team’s safety. You should note, however, that this doesn’t mean you won’t lose any.

Our clients have observed a correlation between drivers who object and those who cause problems elsewhere on the team. So, perhaps you’ll lose a few that are better off elsewhere in any case. But in general, we’ve seen teams rally around a culture of safety.

The data we receive can expose us.

Correct. This data can be discoverable in litigation. That’s why it’s especially important to manage the system well. Make sure you have a process for coaching drivers with lower scores and removing drivers when needed. Data does go both ways; favorable data has been used to defend litigation as well.

What if I want to explore telematics for my stores?

- Connect with us. We can answer basic questions or go as far as getting you an initial meeting with a telematics provider.

- Get a demo. A confident vendor will be more than happy to show you exactly how its product works and the results it’s produced for its clients.

- Get a quote. Let your top two selections send you quotes – and don’t be afraid of asking too many questions. They’ll be happy to review it with you in detail.

- Contact your insurance provider. If not willing to work with us, we’d be happy to. Intrepid Direct can offer you immediate and future discounts on your premiums as a result of integrating telematics with your operations, plus services to help you manage your program.

- Make a selection. Choose the provider that commits to a better future for your drivers and your bottom line.

Categories

Recent Posts

Request a Quote

Ready to take control of your insurance? Request a quote and get the coverage you need all in one place. Remember your broker can’t access us and we don’t interfere with their marketing.